There is a range of records and documents business owners may want to keep track of to manage everything from payroll to bookkeeping. Regularly checking your bank statements allows you to track the account for any mistakes, file taxes, and apply for loans.

by Deborah Findling Jan 05, 2022 — 3 min readPlease note that the information contained in this article is limited in scope and is only intended as a high-level overview of the topics discussed. The information is current as of the publication date only, and the laws (and associated agency and/or judicial interpretations) on the topics discussed could change at any point in the future. Block, Inc. (including its affiliates, subsidiaries, employees, officers, directors, attorneys, and tax advisors) undertakes no obligation to update this article for future changes in the law. In addition, laws vary by jurisdiction, and this article does not attempt to address all jurisdictions — for example, states, counties, or cities often have requirements that differ from federal law. Nothing in this article is or should be used as tax or legal advice. In particular, this article cannot be relied upon for the purposes of avoiding taxes, penalties, or other obligations under applicable law. For guidance or advice specific to your business, you should consult with a qualified tax and/or legal professional .

Managing finances can be stressful. Recent YouGov data shows that financial stability and well-being are tied intrinsically together for many Americans. Of the financially constrained, only two in five of the group felt mentally healthy. While cash flow management can take a mental and emotional toll, there are tools at your disposal to make maintaining your business less taxing.

There is a range of records and documents business owners may want to keep track of to manage everything from payroll to bookkeeping. As a small business owner, regularly checking your bank statements allows you to check your spending and saving habits, track the account for any mistakes or fraud, file taxes, and apply for loans.

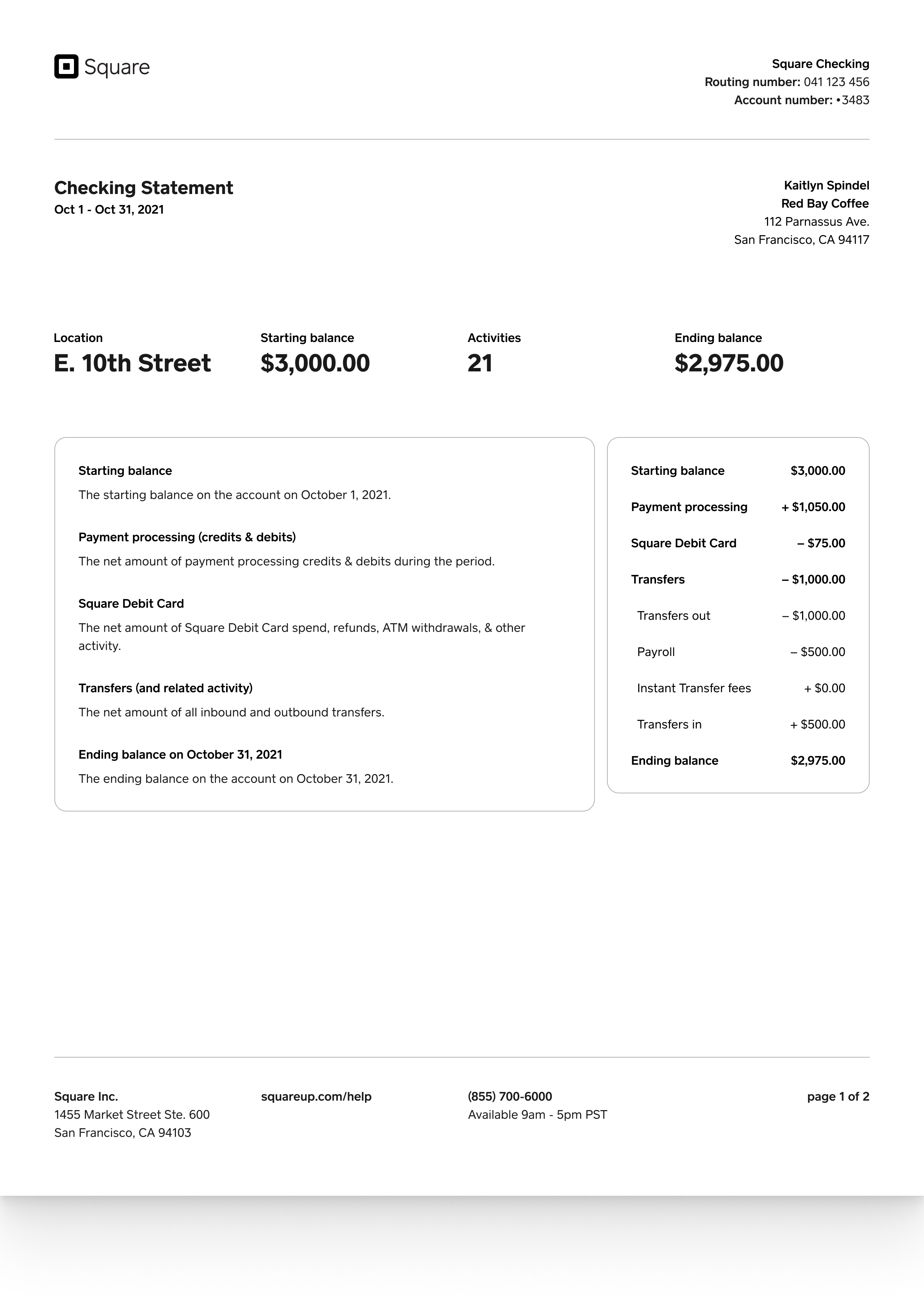

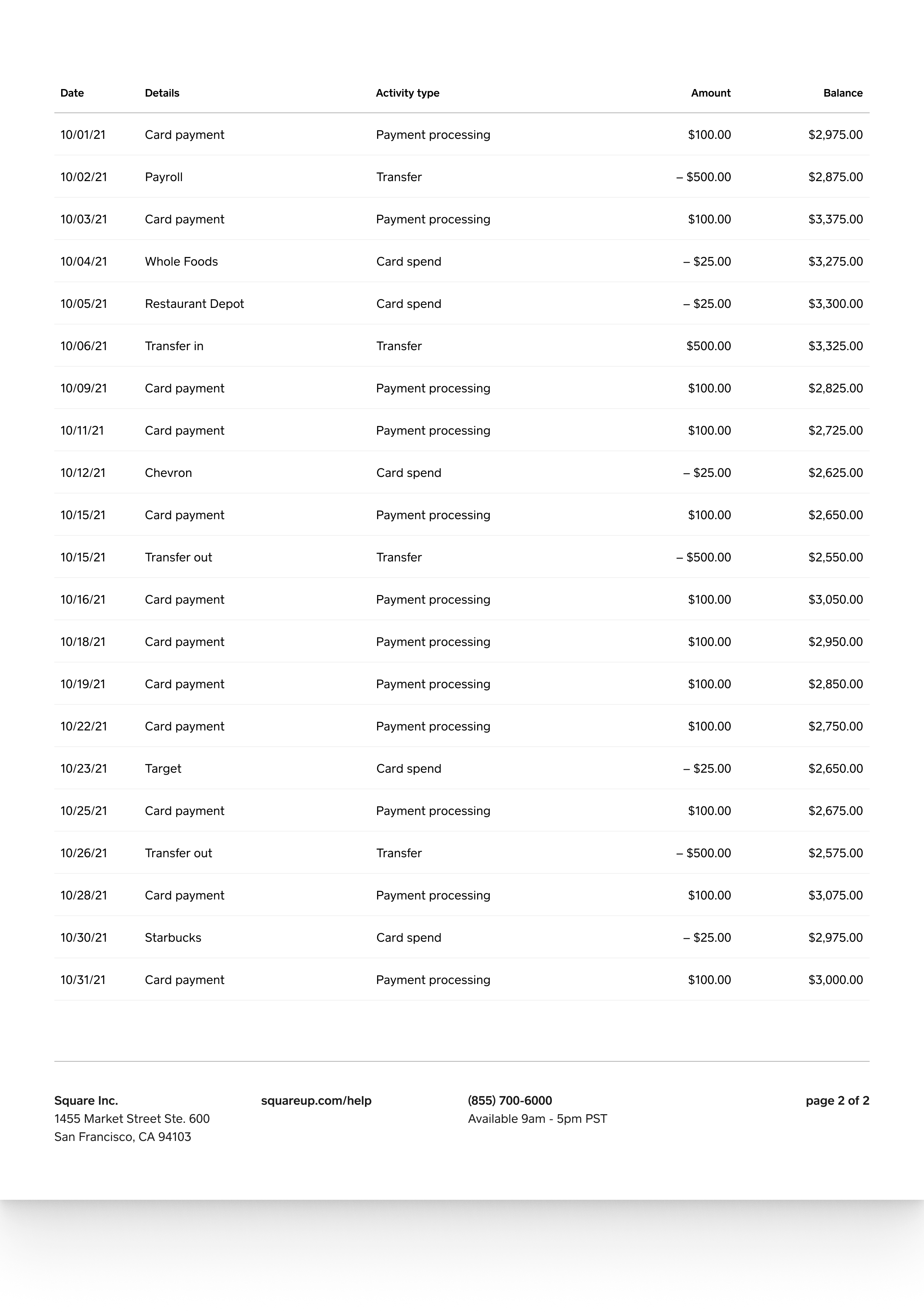

Bank statements are documents that summarize the transactions of a bank account during a period of time, typically monthly. These statements can come from a checking or a savings bank account, investment account, and credit card records. For businesses, there are several reasons why you may want to hold on to these business documents. Here are a few details typically included in a bank statement:

Holding onto bank statements can help demonstrate business activity. Your bank statements and credit card statements also serve as records of your business activities. This is a way to see a picture of your account activity at a glance and can help you find any discrepancies.

Bank statements will help track your business’s progress and, in turn, can serve as a financial record when it comes time to file taxes. These statements are a record of expenses to your business that include item descriptions and costs. While a bank statement can serve as a record of expenses and purchases for your business, be sure to keep gross receipts and other business documents in order to give a complete picture of your business’s finances when filing your taxes.

There are certain tax forms, such as Form W-2 and Form 1099-MISC, where bank statements can be especially useful in filing your tax return. In the U.S., the IRS recommends businesses hold on to their tax returns for at least three years from the time of a tax filing.

Separating your business and personal accounts can help you keep track of the activity related to your business and help protect your personal accounts. Not only will holding on to your bank statements make tracking business expenses more accessible come tax season, they can make finding tax deductions associated with those expenses harder to miss.

When applying for a loan, a lender will typically ask you to include bank statements as a document during the application process. Reviewing your cash flow and income will help a lender determine if you’re eligible for a business loan. Your bank statement can be used to see how often your business is making deposits, inflows and outflows of cash, and how regularly the account sees activity.

Self-employed individuals and contractors may seek a bank statement loan in lieu of a traditional loan. These loans can be issued based on personal information and bank statements rather than the W-2s, pay stubs, and other employer verification forms a lender may ask of you in a traditional loan application process .

If you’re a Square Banking customer, find your Checking statement by navigating to your Square Dashboard and going to Balance > Locations > Checking Settings > Account Statements to download your statement. You can also access your statements from the Activity page in the documents dropdown menu. Be sure to check your account for when checking and savings statements will be available to you monthly.

Deborah Findling is an Executive Managing Editor at Square. She also writes about investment, finance, accounting and other existing and emerging payment methods and technologies.